LightReading recently published a long article detailing the current situation of 5G development in the European market, including the real 5G speed of operators, the sky-high auction price of 5G spectrum faced by countries, the lack of investment and obstacles to market integration.The following is the full text:

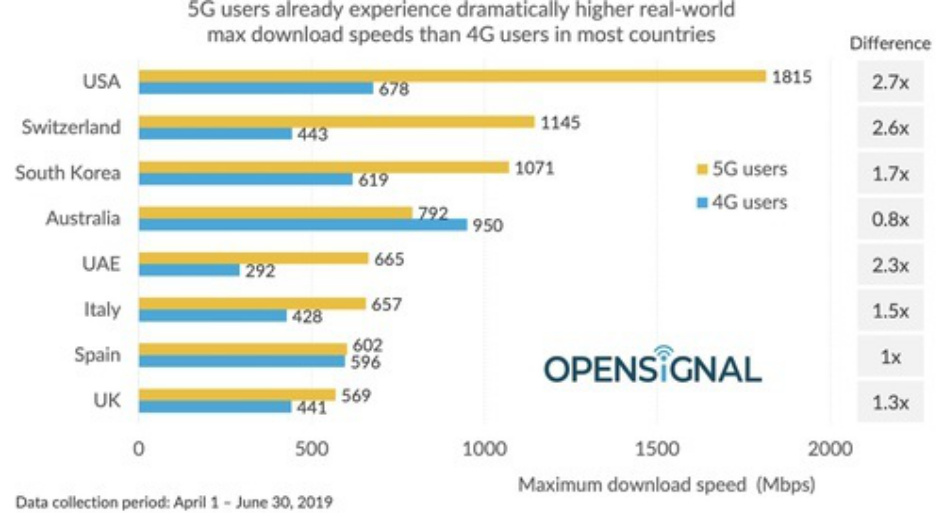

Now, with the currency plummeting, visitors to the UK can enjoy cheaper beer and pub food while also witnessing the world's slowest 5G connections.According to OpenSignal's data, anyone willing to buy an early 5G smartphone could enjoy a top speed of 569 Mbit/s if they were near one of the few mobile base stations in the UK that offers 5G coverage.

That may sound impressive, but it's nowhere near the speed that 5G users can enjoy in countries like the United States, Switzerland, South Korea, Australia, the united Arab emirates, Italy and Spain.Indeed, that's 128 Mbit/s faster than the fastest 4G peak speeds -- a different story in Australia, where the fastest 5G speeds are 158 Mbit/s slower than the fastest 4G connections.So who needs 5G when "old" technology can deliver speeds of up to 950 mbits per second?(at least when it comes to faster mobile broadband...)

Figure 1: OpenSignal survey of global countries 5G and 4G network speed comparison difference.

With the exception of Switzerland, which is usually an outlier in Europe, European countries fared poorly in OpenSignal's 5G speed surveys.But speed is only part of the story.While operators in the U.S. and Asia are trying to expand their 5G networks, many European countries have yet to roll out commercial 5G services.In some European countries that already have 5G, the deployment and rollout can be a long and painful process.It takes time for operators to deploy any new network technology.The worry is that 5G May take longer than usual to roll out.

There are two reasons for this.First, 5G May be far more economically important than it currently seems.If these super-fast connections drive new services, developers could flock to countries with the best 5G infrastructure.Some may be the next Google, while Europe may have its own digital giants.New services could also boost industrial productivity (factory automation is an important area).If Europe lags behind the U.S. and China, companies in the region may struggle to compete on the global stage.

The second reason is that nationwide 5G coverage is still a long way off, which could exacerbate the "digital divide" in individual countries -- the divide between owners and non-owners of digital services.For governments trying to revive the poor and prevent rural areas from slipping into irrelevance, the long road looks awkward.At the same time, populism is on the rise because of a widening gap between rich and poor and a perception that the powerful elite is ignoring the concerns of ordinary people.Operators' choice to concentrate early 5G deployments in places such as London's canary wharf is likely to cause further discontent.

Figure 2:5G development status of European operators.(source: operators, regulators, various news media, compiled by Light Reading.)

Spectrum squeezing

But why is it so hard for Europe to get these countries to move forward with 5G?In countries that have not yet rolled out 5G, it is usually because government authorities have not yet released new spectrum.Most countries in eastern Europe fall into this category, but so does France.Meanwhile, in markets such as the UK, operators are pouring money into back-to-back auctions of 5G spectrum, as if the government is worried that releasing too much spectrum at once could lead to drug overdoses.

The impact is twofold: fragmentation, a digital divide over the whole of Europe, is caused by disunity in different countries and higher costs.Critics say the authorities have pushed up prices by limiting the amount of spectrum sold in any single auction, as operators scramble for scraps.It's like when you throw a piece of meat into a hungry carnivore's den and see what happens.

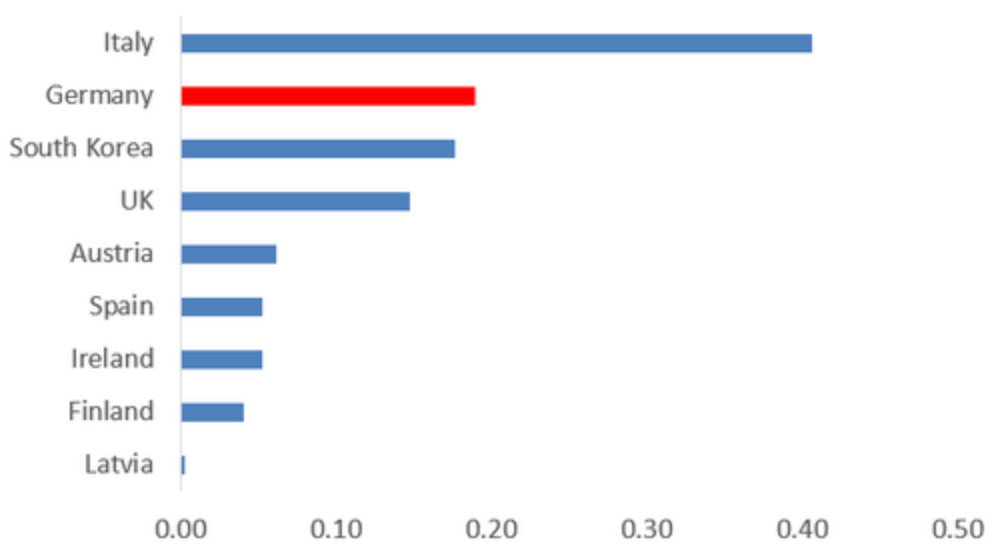

Operators struggling for 5G licences are struggling.After spending €2.2 billion ($2.5 billion) on new 5G spectrum, deutsche telekom says the money could be used to build around 50,000 mobile base stations.The operator launched trial commercial 5G services in Berlin and Bonn this month, but it expects to have no more than 300 5G antennas in service by the end of the year.Deutsche telekom currently has about 28,000 mobile base stations across Germany.

Opponents are indifferent.Operators always complain about unfair regulation, they say, but competition forces them to invest.Another argument is that by giving up spectrum, operators will simply pocket the money, not deploy it.Many short-term shareholders will no doubt agree.France's Orange, one of Europe's biggest operators, is understood to have faced resistance from shareholders in recent years over its big plans for an all-fibre network.

But regulators have an alternative."Beauty contests" are favoured by mobile network providers, where authorities have replaced high spectrum costs with strict coverage obligations.Failure to meet and implement these coverage conditions could result in operators losing their licences, which is the biggest threat.

Germany, however, has been criticised for demanding both high spectrum costs and strict coverage obligations.According to Ericsson, the German auction is clearly designed to maximise returns.Gabriel Solomon, Ericsson's head of European government affairs, said: "there were about 450 auctions, 100 of which were worth €2 billion ($2.3 billion), and the allocation of spectrum has not changed."The final gain was around €6.5 billion ($7.3 billion).At the same time, licensees are required to meet the 98% coverage target by 2022.Angry operators took legal action against the rules and were overruled by the cologne administrative court in March.But that seems unlikely to be the end of the dispute.

Figure 3: price per MHz of spectrum in the 3.4-3.8ghz band in each country, unit: us $100 million.(source: operators, regulators, various news media, compiled by Light Reading.)

Elsewhere, authorities appear to be prioritizing short-term windfalls over long-term 5G gains.In Italy, another European country, where 5G auction revenues have far exceeded expectations, the coverage obligations attached to the crucial "if" spectrum appear less onerous.Operators need to cover a relatively small area of Italian cities, and some rules do not apply to licensed operators with bandwidth below 80MHz, according to Mauro Martino, head of the Agcom spectrum office, the Italian regulator, last year.This would seem to be an excuse for Wind Tre and Iliad, but not for telecom italia and vodafone.

In any case, telecom italia aims to provide 5G services to only 22% of the population by 2021.Operators in other countries have been far more cautious about their network rollout targets, preferring to identify specific cities that 5G will cover."We've announced that by the end of the year we'll have 25 cities covered, but it's not necessarily full coverage -- it's just an appearance."Mike Eales, head of network services strategy and architecture at 3 UK, the UK's smallest mobile operator.

However, other operators' network targets have also been made public.BT, Britain's biggest operator, plans to start 5G at 2,000 of its 19,000 mobile sites by may next year.Deutsche telekom had previously said it planned to cover 99% of the German population by the end of 2025, before paying for its expensive spectrum.Swisscom aims to reach 90% coverage by the end of this year, although the government only wants 50% of the population to be covered by 2024.Swiss-based telekom expects the authorities to relax legislation on radiation restrictions, which could hamper 5G services, if it can prove itself a good citizen.

Balance sheet

But operators have to pay a price.Excluding its huge US business, known as t-mobile US, deutsche telekom's capital intensity -- capital expenditure as a percentage of revenues -- has soared from 14 per cent in 2013 to about 20 per cent last year.Orange has risen from 14% to 18% over the same period.Telecom italia's domestic business grew the most, with its capital intensity soaring from 18 per cent in 2013 to a possible record 37 per cent in 2018, including spectrum costs.These Numbers cannot go up indefinitely.

What makes it harder for them to accept is the lack of any direct sales opportunities for telecoms operators building 5G networks.If mobile history is a reliable guide, users are unlikely to pay more for 5G than 4G.And there is little room for innovation in carrier pricing.Vodafone of the UK hopes that a pricing scheme for different connection speeds and unlimited use will entice customers to abandon plans based on monthly data caps.But if it is welcomed, rivals will eventually respond.James Crawshaw, senior analyst at Heavy Reading, said vodafone's competitive sim-only pricing had raised fears of a "bottoming out".

Figure 4: capital intensity of European operators (eur 1 billion).

Vodafone executives tried to justify the move to reporters at its 5G launch, saying that part of the profits would come from 5G being more "spectrum efficient" than 4G.The basic argument is that sending a bit of data over a 5G network is much cheaper than sending it over 4G.But differences are a bone of contention.Scott Petty, chief technology officer at vodafone UK, told a 5G press conference that 5G will cost four to five times less.At the end of 2017, Johan Wibergh, vodafone's chief technology officer, said 5G would be 10 times cheaper.

Whatever the actual Numbers, investors seem too confident that there will be more to come.Vodafone's share price rose by 2% on the day of 5G's launch, but the company's share price has fallen by 15% this year.BT, its recently announced 5G rival, has seen its share price fall by a fifth over the same period.

Scepticism that spectrum efficiency will boost returns seems justified.Operating costs are unlikely to fall much without layoffs or other cost-cutting measures, such as selling property.The 4G standard was also touted as a more cost-effective technology than 3G, but vodafone's earnings (before interest, tax, depreciation and amortisation) rose just two percentage points in the 4G era, from 29.9% in the year before vodafone launched 4G in the UK to 31.9% in the most recent year.Spectrum efficiency technology appears to be a response to the surge in data traffic, rather than a way to make more money.

"5G will not change the overall cost structure for operators to operate their networks."Bengt Nordstrom, CEO of consultancy Northstream."5G significantly reduces the cost of introducing higher data transmission speeds and adding more capacity.If operators want to improve profitability, they will need to do so through their digital transformation plans."

The debt positions of some big European operators are adding to investors' worries.Telecom italia's net debt was 3.3 times earnings last year, a high level compared with most of its peers.At 2.65, deutsche telekom is approaching the upper limit of its 2.75 comfort zone."Our data do not indicate that we will deviate from the main road...But there will be very little room for manoeuvre."Deutsche telekom CEO Timotheus Hottges said on his latest earnings call.

On market integration

What Europe desperately needs, some analysts say, is more consolidation.The us market, with 330m people, has four big Mobile operators, a number that would shrink to three if t-mobile eventually merged with Sprint.In China, three operators serve 1.4 billion people.

The eu, with a population of about 510m, is home to several big telecoms groups, including deutsche telekom, Orange, vodafone and telefonica of Spain, as well as a host of smaller operators competing with the giants.Gabriel Solomon of Ericsson says many smaller operators are struggling to survive."The fixed cost base is similar to operators with larger market share, and it is much more difficult to maintain and generate returns."He said.

In this worldview, everyone is worse off as incumbents settle for a smaller market share and competition drives prices down.Gabriel Solomon believes operators need a 38 per cent EBITDA margin to achieve "optimal investment levels" and says the European average is much lower.Vodafone's European adjusted EBITDA margin last year was 31.6 per cent.After adjusting for special factors, deutsche telekom's margin is 30.8%.

Unfortunately for investors, European regulators have continued to oppose mergers and acquisitions, arguing that they will lead to higher prices and hurt consumers.Proponents of the European approach point out that in the less competitive us market, customers tend to pay more for telecoms services.But that means European operators face spending constraints, says Nordstrom, a consultancy."The biggest challenge in Europe compared to the us is that our revenue per user is much lower, so our starting point is that if we break it down into investment per user, we have less money to spend."He said."This is driven by resistance to European market integration."

According to the GSMA's analysis, the deal improved network coverage and connection speeds by 20-30 per cent after regulators allowed Hutchison and Orange to merge their Austrian operations in 2012.

As the eu chooses new leaders, the telecoms industry is watching to see if a more investor-friendly regime emerges.But a more relaxed approach to domestic mergers and acquisitions will not solve Europe's divisions or help the cross-border market for telecoms services.Even deutsche telekom's efforts to build a single network across several European countries have been somewhat frustrated by national regulators' requirements for local data facilities to prevent information from being stored in another European jurisdiction.

In today's political environment, these objections will not be easily resolved.For populists across the region, the eu is an inexplicable, kafka-like monster that deprives nation-states of their rightful sovereignty.British voters voted to leave the eu in a referendum in 2016 (which triggered a devaluation of the currency, which explains why beer and food are now relatively cheap for European tourists).With or without a deal, brexit will take place in October.That could spur demands for referendums from other eu members.

No doubt the arguments for and against more European integration will continue.But with China and the United States ramping up 5G muscle, there will be less skepticism in the industry about advancing new technologies and methods."It's critical to see connectivity as the cornerstone of a new industrial strategy, and I don't think the eu has done that yet."Gabriel, Solomon said."If we continue this fragmentation, other superpowers will accelerate into the digital realm.

Inglês

Inglês  Chinês

Chinês  Alemão

Alemão  Coreano

Coreano  Japonês

Japonês  Farsi

Farsi  Portuguese

Portuguese  Russian

Russian  Espanhol

Espanhol